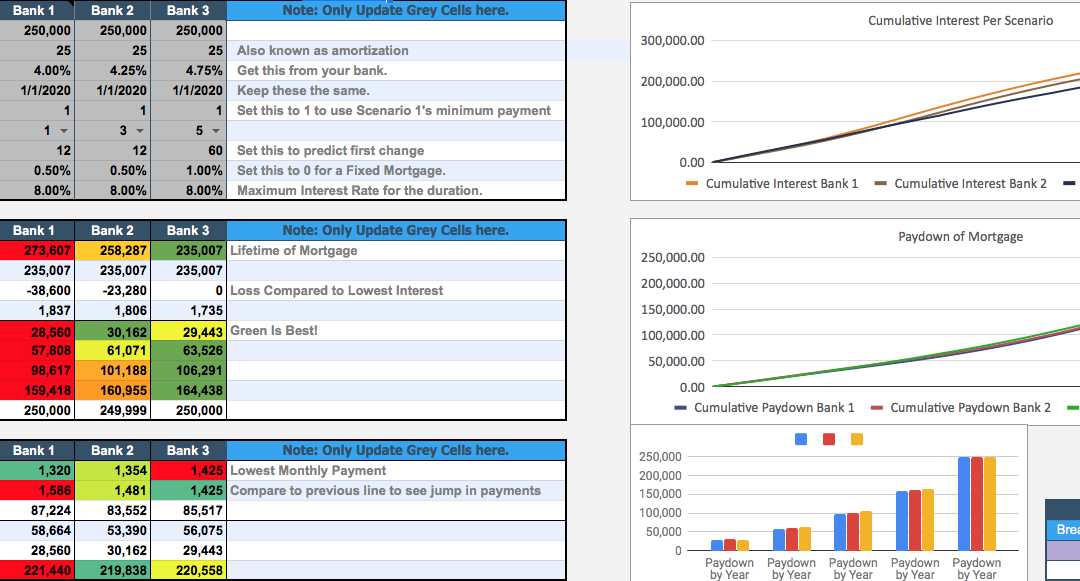

When you are faced with different mortgage offers, it is important to look at all of the variables. This calculator allows you to compare 3 different mortgage conditions and see the effect they would have over the lifetime. You can also run some sensitivity analysis to model future interest rate changes and lump sum payments.

Being able to compare different scenarios for your mortgage can help you save big $$$. Remember that you can always negotiate with Lenders. They have the power over you because they have similar calculators. No longer… 🙂 Should you pick a fix or variable rate? What about your payment frequency? Have you thought about making an extra lump sum payment? Knowledge is best, don’t be fooled by their sales pitches! Learn all the math involved before making that important decision.

The 3 Mortgage Calculator is a Google Spreadsheet that you can copy for your own use. Have fun and don’t let the banks push you around!

How to Make a Copy for Your Own Personal Use |

| 1) On the menu at the top of the page click on ‘File’ |

| 2) Select ‘Make a copy’ from the drop-down list. |

| 3) Optionally give a new name to your copy on the popup window, and you may also select another folder where to save the copy. Or else you can also leave these boxes as they appear by default. |

| 4) Click the [OK] button. |

| How to Print a Sheet Into a PDF File |

| 1) On the menu at the top of the page click on ‘File’. |

| 2) Select ‘Print’ from the drop-down list. |

| 3) Click the blue [NEXT] button on the top right. |

| 4) Select ‘Save File’ Radio Button and then click the [OK] button. |

| 5) Your PDF file will be saved into your local download folder (or pre-selected download location). |

| 6) The PDF file (or selected pages of it) can be printed on paper from any PDF reader. |

| How to Share Your Copy of This Google Worksheet |

| 1) At the top right corner click on the green [Share] button. |

| 2) On the left of the [Copy Link] button choose your sharing preference. Like ‘Anyone with the link Can Edit’, or ‘Anyone with the link Can View’, etc. |

| 3) Copy the link that is displayed, and click the [Done] button. |

| 4) Send the link to people who you want to invite for viewing, commenting, or editing your Google Worksheet. |

| 5) If you enter the email address into the box on the pop-up window then those people will get an email invitation. |

| 6) The Editing, Commenting, or Viewing permissions may be revoked any time you want, by clicking the [Share] button and changing your settings. If you set the sharing option to ‘OFF – Only specific people can access’ then you can restrict access even further to make it private or share with only selected people. |

| About This Google Spreadsheet |

| This spreadsheet creates an amortization table and graph for an adjustable rate mortgage (ARM) loan, with optional extra payments. Results may differ from other calculators due to rounding or how payments are processed. |

| Some Notes and Assumptions |

| The maximum rate and monthly payments are just estimates! The estimates are based upon the specified interest rate cap and the estimated adjustments over the term of the loan. |

| • The calculator is designed to handle monthly payments only. |

| • Payment and interest calculations are rounded to the nearest cent (2 decimal places) |

| • Interest rate changes are theoretical (designed to allow you to test different scenarios) |

| • The Payment Due is adjusted after each payment, so extra payments lower future monthly payments rather than resulting in paying off the loan early. |

| • The calculator does not take into account fees, insurance, taxes, etc. |

| • Read cell comments (cells with red triangles) for more information. |

| The “Tabulated” worksheet is a variation of the ARM Calculator that allows you to specify the dates when interest rates change. If the date does not correspond to a Payment Date in the Amortization Schedule, the rate change is not applied until the following payment. Interest is not calculated on a daily basis. |

Recent Comments