A reader asked if it is best to only invest in a cash-flowing properties. The answer is “most of the time, but not always”. There are many considerations from the location, your personal situation, the macro economic fundamentals, to local regulations.

What is a Cash Flowing Property?

A cash flowing property is one that produces positive cash flow after paying the expenses and the debt service. Simply put, at the end of the year, all of the rents you received are greater than your expenses and mortgage payments.

Advantages

- Less Stress. You do not worry about making payments.

- Liquidity. You do not need to add extra cash every month/year.

- Scale. You can own a lot more properties.

- Profit. You are profitable. 3 Ways You Make Money Renting Out a House

- Less Risk. Hard times can be handled more smoothly.

Disadvantages

- Hard to find. Real Estate Markets are efficient in their pricing; finding a cash-flowing property can be difficult.

- Rapidly Rising Markets. You miss opportunities in rapidly appreciating markets.

- Riskier Markets. Cash Flowing properties typically exist in markets that grow less quickly, or have inherent more difficult tenants.

Fooling Yourself

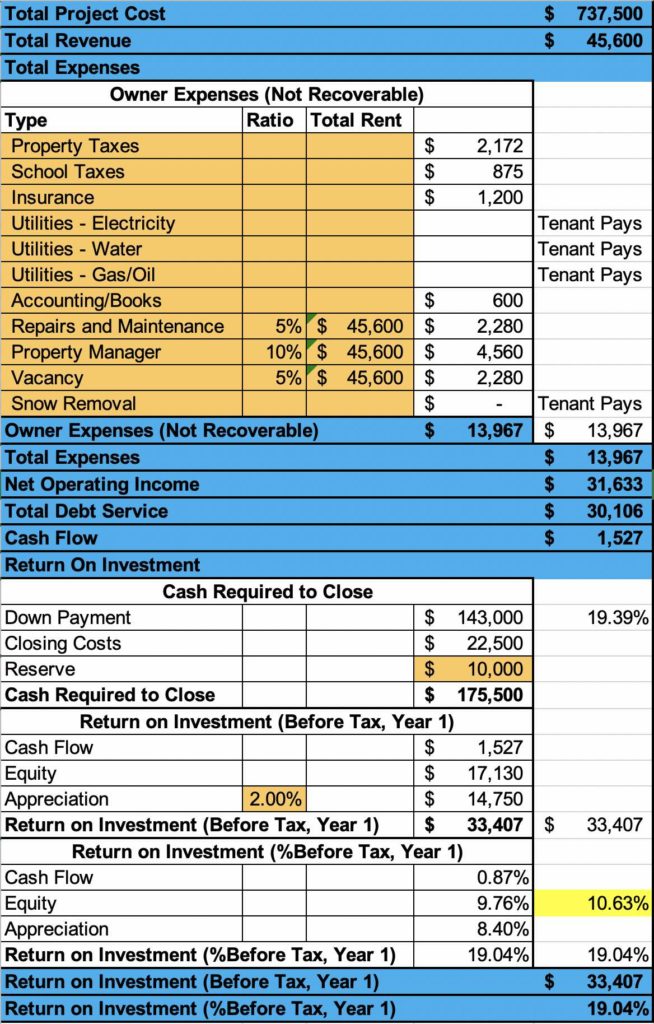

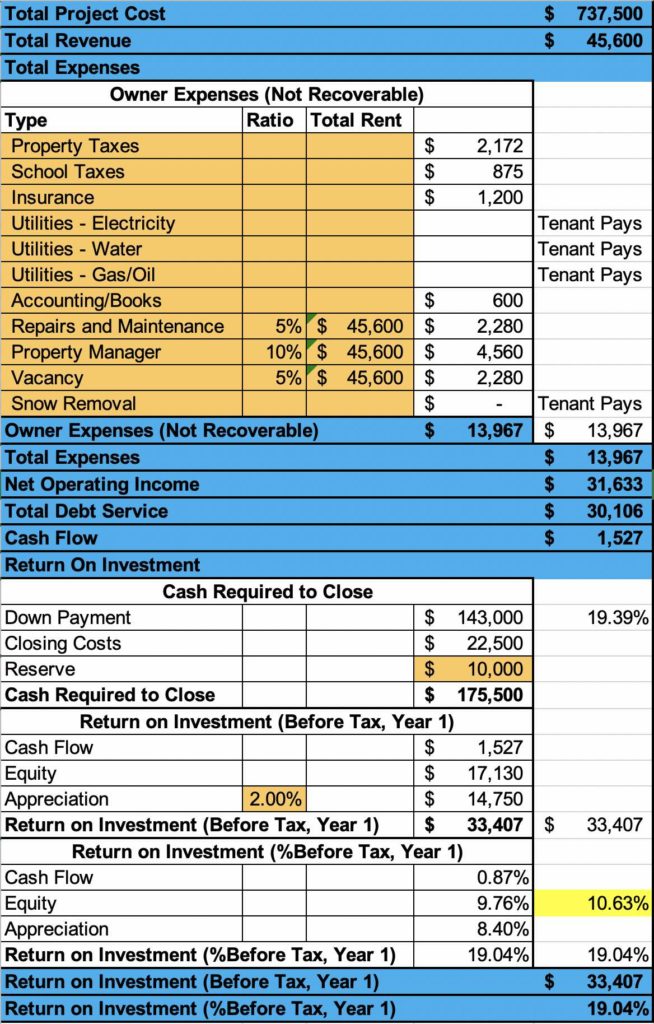

There are many ways you can fool yourself into believing you have positive cash flow. See below a proforma that has a slim $1527 positive cash flow, with all expenses being accounted for. This would be a very positive sign to purchase such a property.

Click here to learn more

A sample Proforma

Work in your own Property

A good way to add cash flow to a property is to work in it for “free”. Many first time investors do this in the early years, knowing that the property will eventually be able to raise rents enough to cover these. This only works for just a few properties, does not scale, and is technically not a cash-flowing property.

- Property Management.

- Repairs and Maintenance Work.

- Book Keeping.

Ignore Budget Items

When analyzing a property financially, it is key not to lie to yourself, and adjust estimates for the particular property.

- Repairs and Maintenance Budget. Very different for student rentals versus high end condo versus single family home.

- Vacancy. What kind of turnover exists, and how many months to fill a property?

High Down Payment

It is very easy to make a property cash flow with a 50% down payment. The problem with this is that you money will not work very hard. The return on investment will drop dramatically. Many people like to use 20% down payment for residential and 30% for commercial.

Considering Negative Cash Flow

There are times when investors consider this.

- Speculation. The market is on an upward trajectory.

- Adding Value. Temporarily renovate the property and get higher rents. Discover How to Turn $1 into $15 with Commercial Real Estate

- Changing Use. Change to AirBnb, or add an extra unit.

- Flipping. Buy, renovate, sell. Short Term.

- Diversification. The negative cash flowing property is part of a larger portfolio that cash flows.

Conclusion

Investing in cash flowing properties is a very good sustainable and scalable strategy where you can “get rich slow with minimal stress” by following some simple strategies. Negative cash flowing properties are with more speculative or involve more work. Finding the right combination for your own personal investing journey is key. Good Luck!

If you made it this far, you may like the following:

- 3 Ways You Make Money Renting Out a House

- Discover How to Turn $1 into $15 with Commercial Real Estate

A sample Proforma

Recent Comments