“Should My Parents Renovate and Rent The Family Home?” Many readers ask me variations of the same question regarding getting more value out of a home they already own. Read on for my answer.

The Question

Dear Marc,

I have seen people make Real Estate Investments on gut feeling, and others never act because they are waiting for the perfect deal, which typically does not exist. Every investment is a calculated bet, so have your parents do reaonable homework, and then take an informed action.

My parents own it free and clear for $530,000, and think they could sell it for $1,000,000. I have been told that it would take $600,000 to bring it up to code, and when that is done, it would fetch about $60,000 a year in rent, and it will be worth $1,400,000.

In terms of a renovation, the ideal situation would be that once it’s all said and done, we can rent out all three units, create positive cash flow, and refinance so my parents can purchase another property. What should I do?

Alice

The Answer

First, congratulations on your parents paying off the entire property! They are already in a good position. I also think it is great that they would think about refinancing and buying more property. It means they understand the concept of leverage, and that their money grows faster when tenants pay for a mortgage.

Your money works harder when you own 4 properties at 25% with mortgages, than 1 property with 100%.

De-personalize the property.

Forget that you own the property. This allows you to avoid Sunk Cost Fallacy whereby you may make a decision clouded by simply owning the property.

It is a worthwhile mindset shift to realize that if they sold the property, they would have $1,000,000 to work with (ignoring real estate commissions). Picture yourself having sold the house, having a briefcase with $1M in it and standing outside that very same house, and asking yourself if you would buy it.

Would you buy this building for $1,000,000 and add $600,000 for a total price of $1,600,000 in order to ultimately rent it for $56,200 per year”?

Do the Math

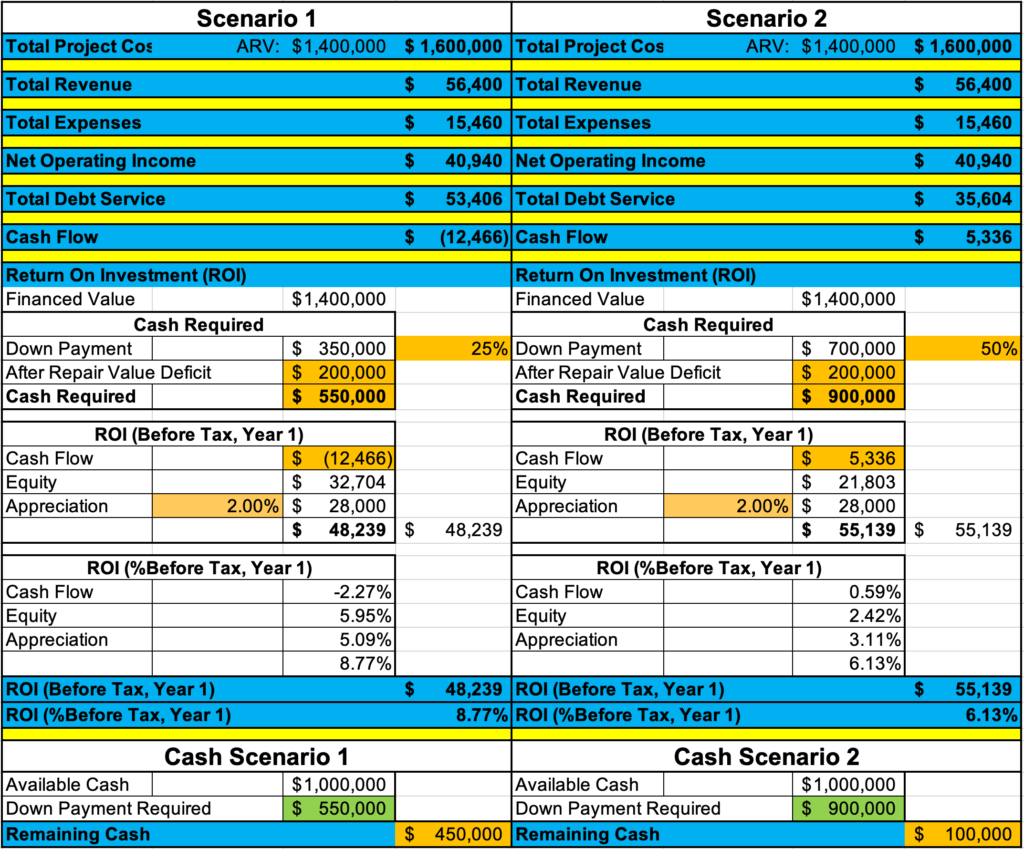

So, you have a briefcase of $1M. You are considering buying the property, renovating for $600,000 and then it will have an After Repair Value of $1.4M. Here are two scenarios:

Scenario 1:

- The property will need extra cash every year: $12,466

- The Return on Investment will be 8.77%

- You will still have $450,000 to buy another property (no cash down!).

Scenario 2:

- The property will generate extra cash every year: $5,336

- The Return on Investment will be 6.13%

- You will still have $100,000 to buy another property.

Get Better Numbers

Your parents appear to have preliminary information that $600,000 will result in an increase in value of $400,000, for a loss of $200,000 in equity. This is entirely possible in certain environments, but not likely in most. My recommendation for your parents:

- Get a true assessment of the value of the property as it is. An appraiser can be hired, and/or a realtor consulted. The former will push the price below market value and the latter may exaggerate the price.

- Get quotes from general contractors to come in and provide a quote for your plans.

- Update the Financial Model.

Family (Partner) Meeting

Have a family meeting where you sit down and discuss the analysis and a whole bunch of other points, including the following.

- Do the Numbers Make Sense?

- Will a Bank finance your parents for the extended amount?

- Who will manage this property? Is this a family business?

- How many more properties will there be?

- Will your parents live in one of the units?

- What will your parents do with the remaining cash?

- Can your parents’ $1M suitcase of cash be used elsewhere?

- What is the economic environment of the neighbourhood?

- When is the best time of year for the renovation?

- Will the municipality allow the plans you have in mind?

Make a Business Decision

- Do nothing. Live in the status quo.

- Renovate and Refinance the property yourself.

- Renovate and Refinance the property with an expert partner.

- Sell the property.

- Refinance the property, and invest in another property.

Conclusion

This blog post is by no means a definite answer for your question. Hopefully, it gives you a quick understanding of the issues at hand and some kind of mathematical model to get a grip on some of the numbers.

I have seen people make Real Estate Investments on gut feeling, and others never act because they are waiting for the perfect deal, which typically does not exist. Every investment is a calculated bet, so have your parents do reaonable homework, and then take an informed action.

If you have more questions, then please post them below in the comments section for the benefit of the other readers.

Happy Analysis and Good Luck!

Proforma Assumptions

- Mortgage of 2%, 25 years amortization.

- Your parents can qualify for the mortgage.

- Appreciation of 2%.

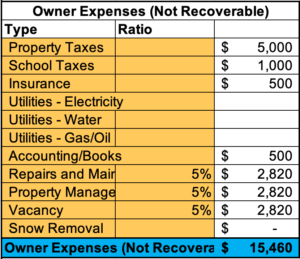

- Expenses.

- Property Management. Some people do this on their own, and this can go to 10%, depending on the market.

- Repairs and Maintenance. This can vary based on tenant profile and how new the property is.

- Vacancy. Well managed buildings can near 0.

- Utilities, paid for by the tenant.

Wow Marc! Thank you so much for this awesome breakdown!

We will be working with a building consultant and hopefully getting some better numbers to run a more accurate analysis! Will keep you posted on what we end up deciding 🙂