It is possible, with no money down, to turn your basement into a rental and get a tenant to pay for it plus some extra profit! This is great for young people buying their first house, older generations on fixed income, or the typical real estate investor that wants to create positive cash flow.

Is Your Property Eligible?

Find out if your property is eligible for adding an extra unit. In some municipalities, the concept of a granny-suite in the basement may not be legally permitted. There are also security requirements that must be met.

So, before you continue, find out if the changes you are planning meet all municipal guidelines.

Is Your Family Onboard?

Your partner may not want a tenant living in the basement. Even your extended family will have numerous objections:

- Your Uncle XYZ lost money in real estate!

- Do you want to fix a broken toilet on New Year’s Eve?

- You deserve to live without tenants.

- The contractor will overcharge you.

- Tenants are a pain in the butt…

The list of objections is endless. To move forward, only thee things are required.

- Focus on getting your spouse onboard; this is a joint decision.

- Ignore the extended family; this is your life.

- Envision the ideal tenant for you; design everything for them.

How to do it with “No Money Down”?

0% Cash, 100% Borrowed

The no money down approach: if your house is worth a lot more than your mortgage you can get a Home Equity Line of Credit (HELOC). Use this to finance the entire construction of the project.

20% Cash, 80% Borrowed

If your HELOC is not enough, you can use a progress Draw Construction Mortgage (PDCM). Your bank will work with you to look at your plans, and lend you money at key phases during your construction project. Typically, you will need to put in an amount yourself, like 20% of the amount of the construction. It is possible to get 100% financing in this case, but it will all depend on the value of your home after the renovation.

100% Cash

You save up enough money for the project, and pay it all yourself. This is the least risky approach, but your Return on Investment is the lowest. Ideally. after the renovation, you go to your bank and refinance this amount; the tenant pays for your mortgage and your get your cash back.

Will it Make Financial Sense?

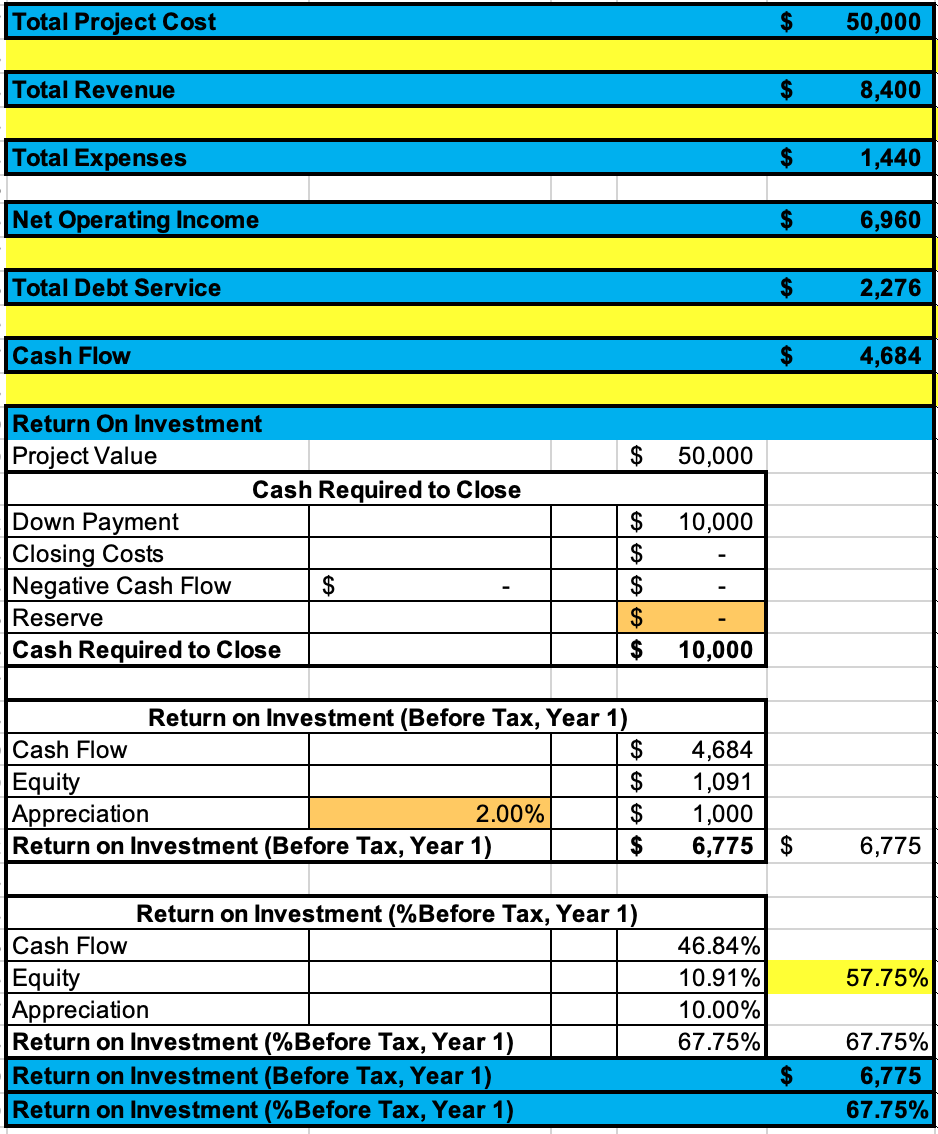

It is quite rare that this kind of project does not make sense. The financial example below shows a $50,000 renovation with $10,000 down, with a “Progress draw Construction Mortgage”. Imagine have a 67% Return on Investment, with $4,684 of cash (pre-tax) in your pocket every year!

Your Return on Investment is Infinite if you use the “no cash down approach”.

Note: Talk to your accountant since there are tax consequences to consider, both on income and resale of the property.

Can I do More?

- Basement Living. Some ambitious people live in the basement and rent out the bigger unit. This is a great strategy to live somewhere for “free”, since the bigger unit sometimes pays off the ENTIRE mortgage payment.

- Rinse and Repeat. After a few years, buy another house, keep the first one and do it again! Imagine a new house every 5 years!

- Other Models: Convert a Duplex to a Triplex. (n-plex to n+1 plex)

- Garages and Secondary Dwellings. In some municipalities, garages can be converted into rental units.

- Do it While Single. Do this before you have a partner, and build your wealth faster. Move into the basement, and rent the main floor. Watch your wealth grow by the time you are 30!

Conclusion

This strategy clearly demonstrates that with some ambition and entrepreneurialism, it is possible to live in a nice location, subsidized by a tenant, and have more financial stability. I encourage young people starting off in life with this strategy, and have seen it repeated successfully.

Recent Comments